The risk agenda is a new feature available in My DSO Manager, credit management and collection SaaS software, allowing you to manage customers risk thanks to automatic and manual actions available in an agenda and on the customer file.

It complements and enhances existing risk functionalities, including the credit limit validation workflow , by defining standard rules (for exemple, credit limits duration validity...) or by customizing the rule when necessary taking into account the situation of each customer.

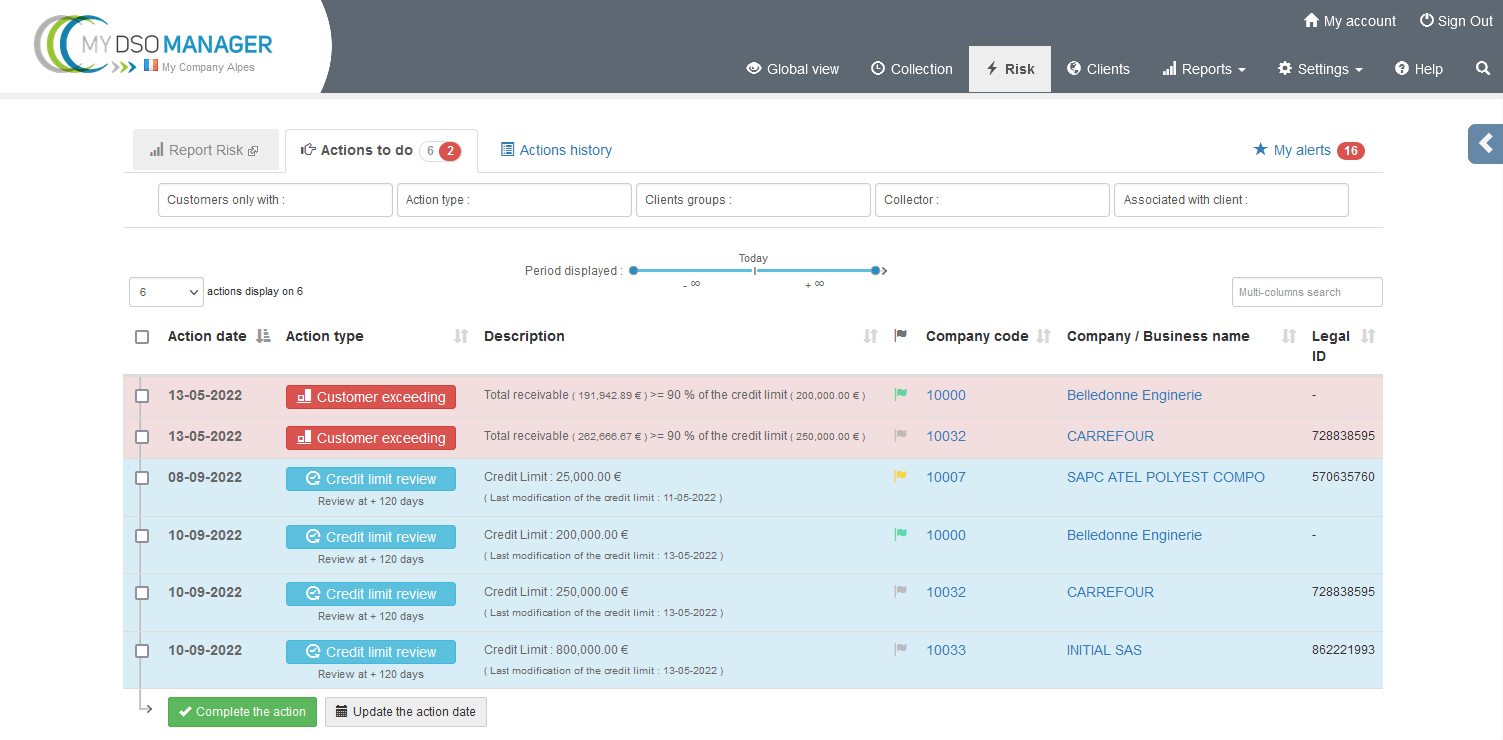

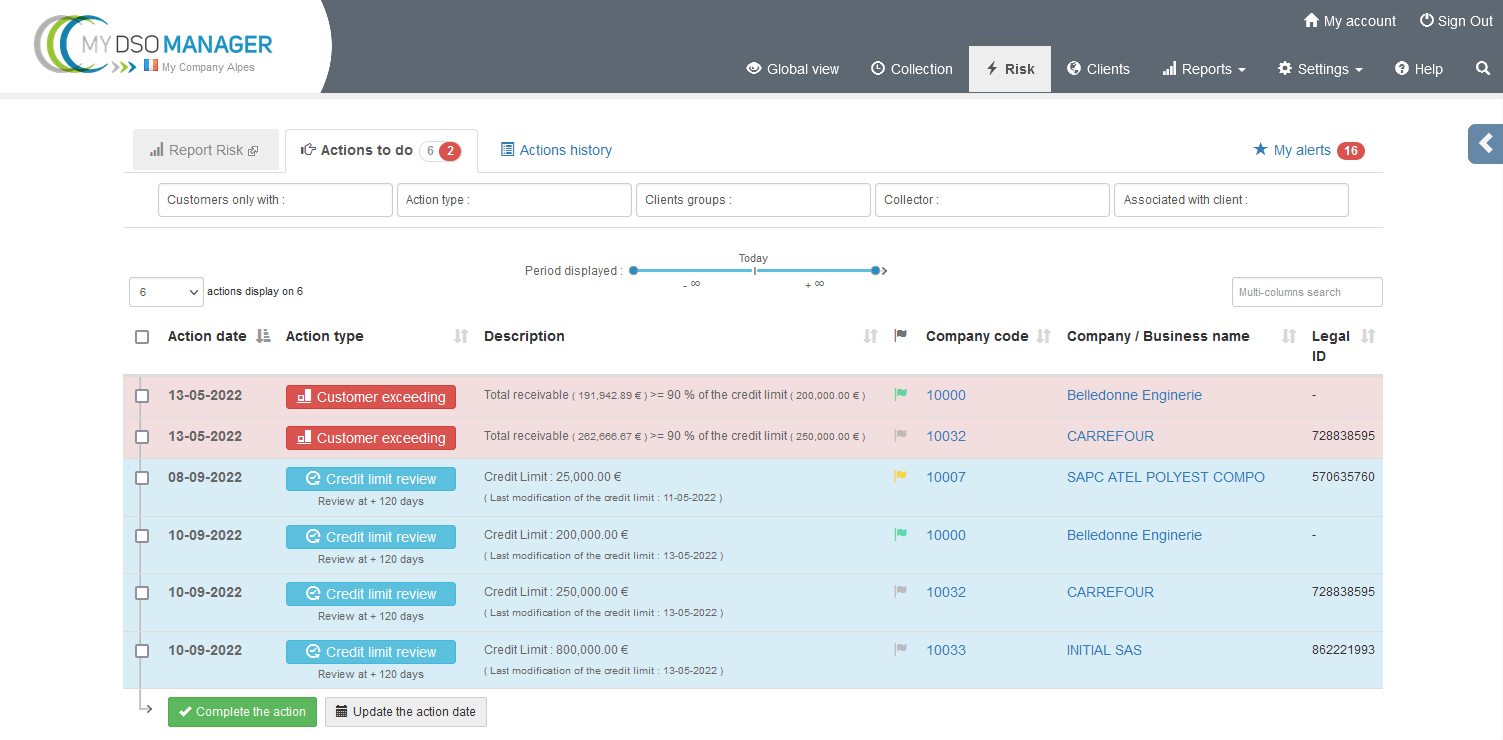

The objective is therefore to get a daily agenda with predefined actions to anticipate and control customer risk.

The risk agenda makes possible to optimally manage customer risk by generating follow-up actions on several axes:

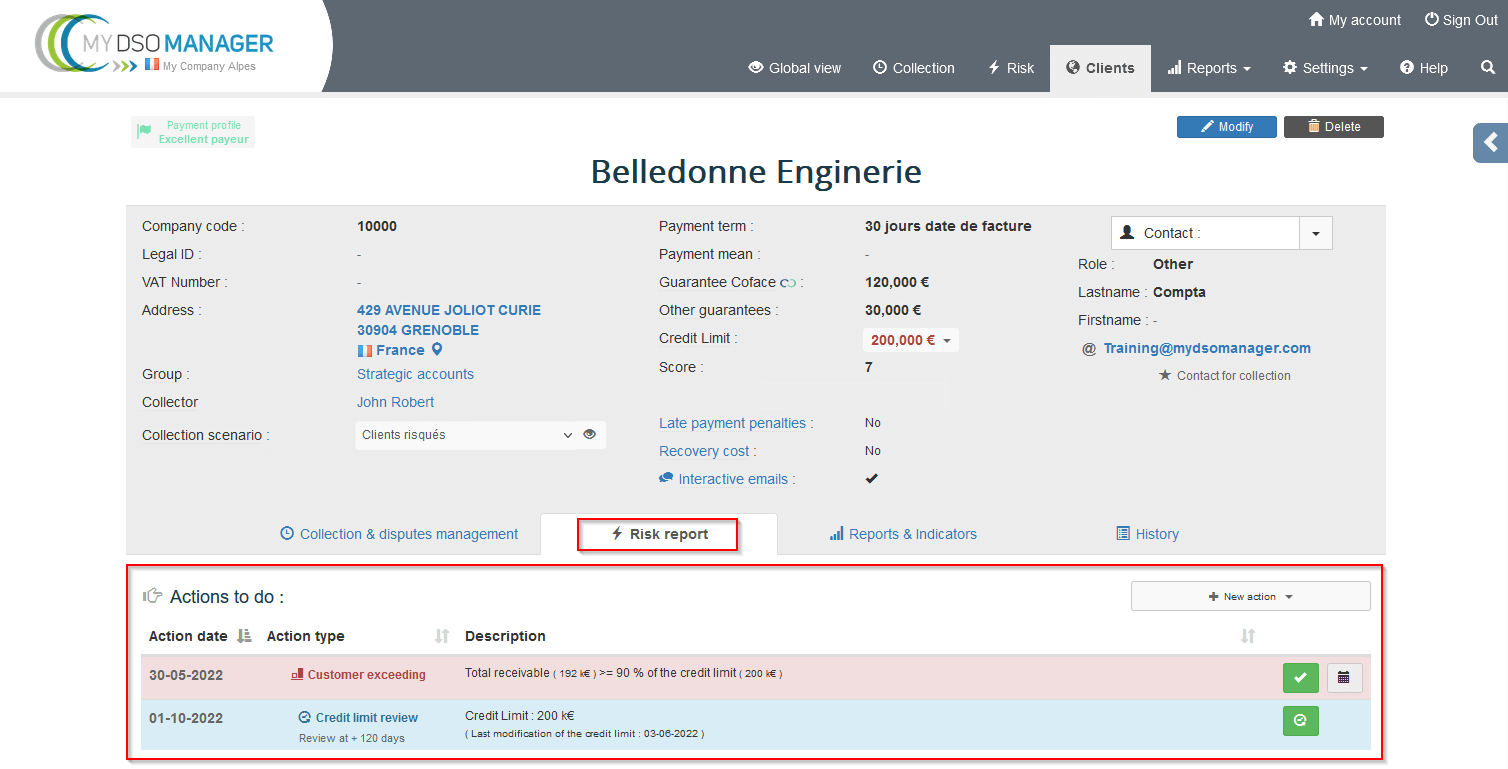

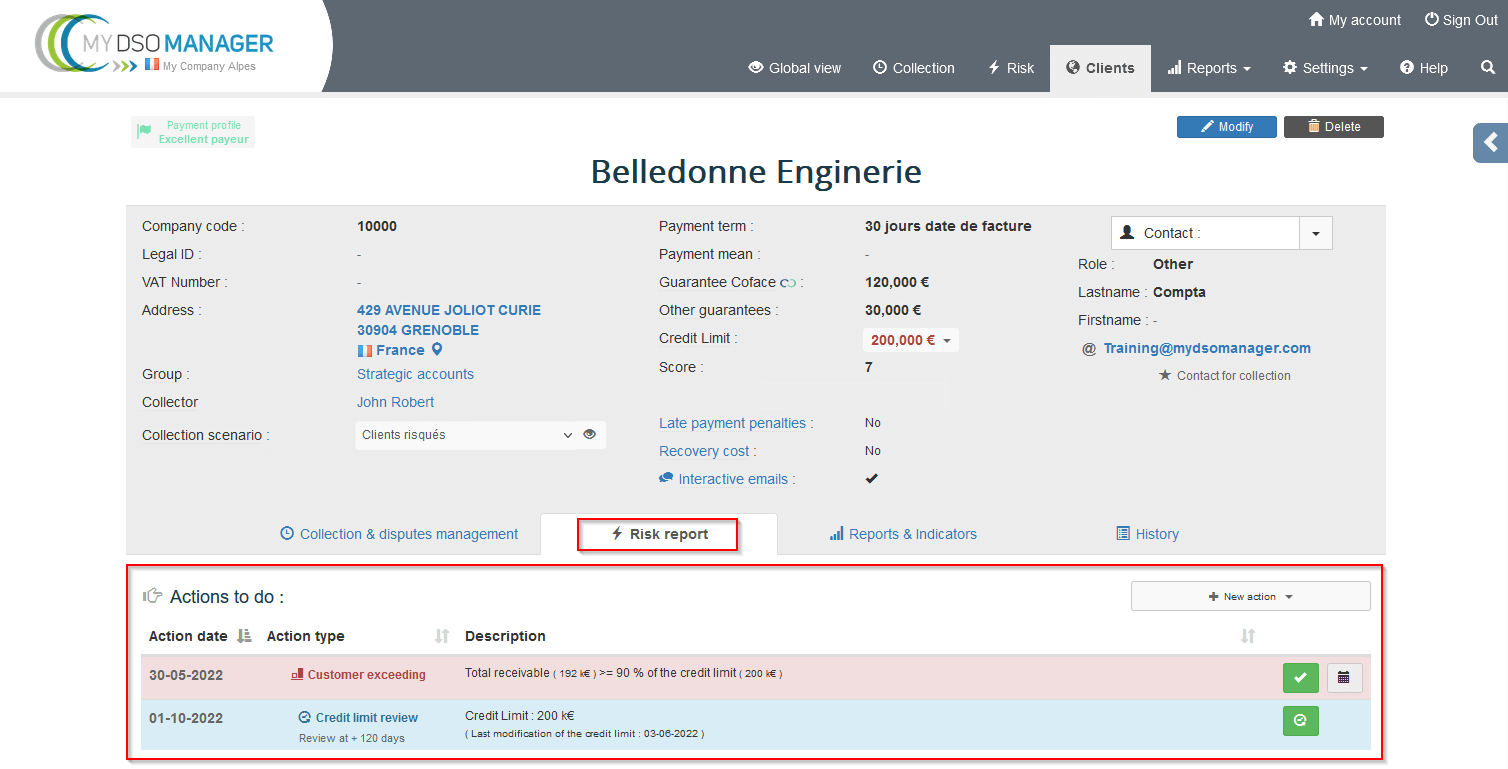

The agenda is accessible in the Menu of your My DSO Manager platform. You can also find the actions at the level of each customer file in the "Credit & risk" tab.

Please read our tutorial before starting.

Check our online help on the risk agenda:

It complements and enhances existing risk functionalities, including the credit limit validation workflow , by defining standard rules (for exemple, credit limits duration validity...) or by customizing the rule when necessary taking into account the situation of each customer.

The objective is therefore to get a daily agenda with predefined actions to anticipate and control customer risk.

The risk agenda makes possible to optimally manage customer risk by generating follow-up actions on several axes:

- Credit limit reviews

- Customers in excess: alert when the total outstanding amount reaches xx% of the credit limit

- User-created custom actions.

The agenda is accessible in the Menu of your My DSO Manager platform. You can also find the actions at the level of each customer file in the "Credit & risk" tab.

Please read our tutorial before starting.

Check our online help on the risk agenda: