My DSO Manager is an innovative SaaS (Software as a Service) software solution for credit management and cash collection between professionals, fast growing solution in Europe and in the World!

It includes innovative functionnalities allowing efficient credit risk management, cash collection, dispute management, reporting, cash forecast, etc.

Entirely designed by credit management professionals, it is affordable to all sizes of businesses. Quick to set up thanks to our Smart upload AI module, ergonomic and scalable for users, My DSO Manager is used by 1,800 companies in more than 85 countries. Large international groups, Mid-Size Companies, SMEs and simply use the most modern and efficient credit management software.

The solution natively integrates the management of all existing currencies. The multi-entity platform makes it possible to consolidate data and reports for international groups in real time. The user interface is available in 15 languages, 170 for dunning letters.

They have a direct impact on cash flow and profitability, key elements for the sustainability and development of any company. The use of specialized software is essential in order to achieve good results with maximum efficiency. However, traditional solutions are not suitable for most companies because they are cumbersome to set up and too rigid from a functional point of view.

Objectives of My DSO Manager are:

The use of specialized software is essential in order to achieve good results with maximum efficiency. However, traditional solutions are not suitable for most companies because they are cumbersome to set up and too rigid from a functional point of view.

Objectives of My DSO Manager are:

An efficient recovery of bills, an optimal resolution of disputes and a good control of its customers' payment default risk reduce DSO and improve cash flow and profitability of its business. My DSO Manager is the tool to manage his DSO, that is to say to control its evolution and to perform all the necessary actions to improve it.

My DSO Manager is the tool to manage his DSO, that is to say to control its evolution and to perform all the necessary actions to improve it.

It includes innovative functionnalities allowing efficient credit risk management, cash collection, dispute management, reporting, cash forecast, etc.

Entirely designed by credit management professionals, it is affordable to all sizes of businesses. Quick to set up thanks to our Smart upload AI module, ergonomic and scalable for users, My DSO Manager is used by 1,800 companies in more than 85 countries. Large international groups, Mid-Size Companies, SMEs and simply use the most modern and efficient credit management software.

The solution natively integrates the management of all existing currencies. The multi-entity platform makes it possible to consolidate data and reports for international groups in real time. The user interface is available in 15 languages, 170 for dunning letters.

A software that covers major stakes

The collection of trade receivable and the management of the risk of non-payment are vital issues for companies, whatever their size).They have a direct impact on cash flow and profitability, key elements for the sustainability and development of any company.

- To provide all companies with personalized functionalities to optimize their processes and digitize their cash collection.

- To democratize good Accounts Receivable management practices thanks to a tool that allows them to be implemented collaboratively.

- To drastically simplify the constraints of implementing and using the tool thanks to an ERP agnostic software.

- To increase the power of the software by interconnecting it with a set of third-party solutions.

Why the name My DSO Manager?

The DSO is the Days Sales Outstanding acronym. It is the key performance indicator for the management of accounts receivables and debt collection. It is the number of days of sales invoiced and not yet paid.An efficient recovery of bills, an optimal resolution of disputes and a good control of its customers' payment default risk reduce DSO and improve cash flow and profitability of its business.

Principles and features

Key Principles

|

Intuitive. Take easy control of the functionalities in My DSO Manager in a pleasant and flexible environment. Involve your teams and your customers in your process. |

|

Affordable. My DSO Manager is an attractive international Credit Management solution suitable for any size of businesses: large worldwide Groups to small and medium enterprises. Quick and flexible implementation allows to adapt My DSO Manager to your organization. |

|

Innovative. My DSO Manager offers the most innovative and digital credit management functionalities, 100% in real time, whether in cash collection (interactive e-mails, personalization in automation), risk management (risk agenda, workflow, etc.), cash forecast, dispute management, etc. Take advantage of access via smartphone. |

|

Effective. My DSO Manager offers a powerful set of features to digitalize Accounts Receivable management and to speed up the collection of your company’s receivable while improving customer relationships. |

Key features

My DSO Manager provides high performance and innovative features that you will take control easily.

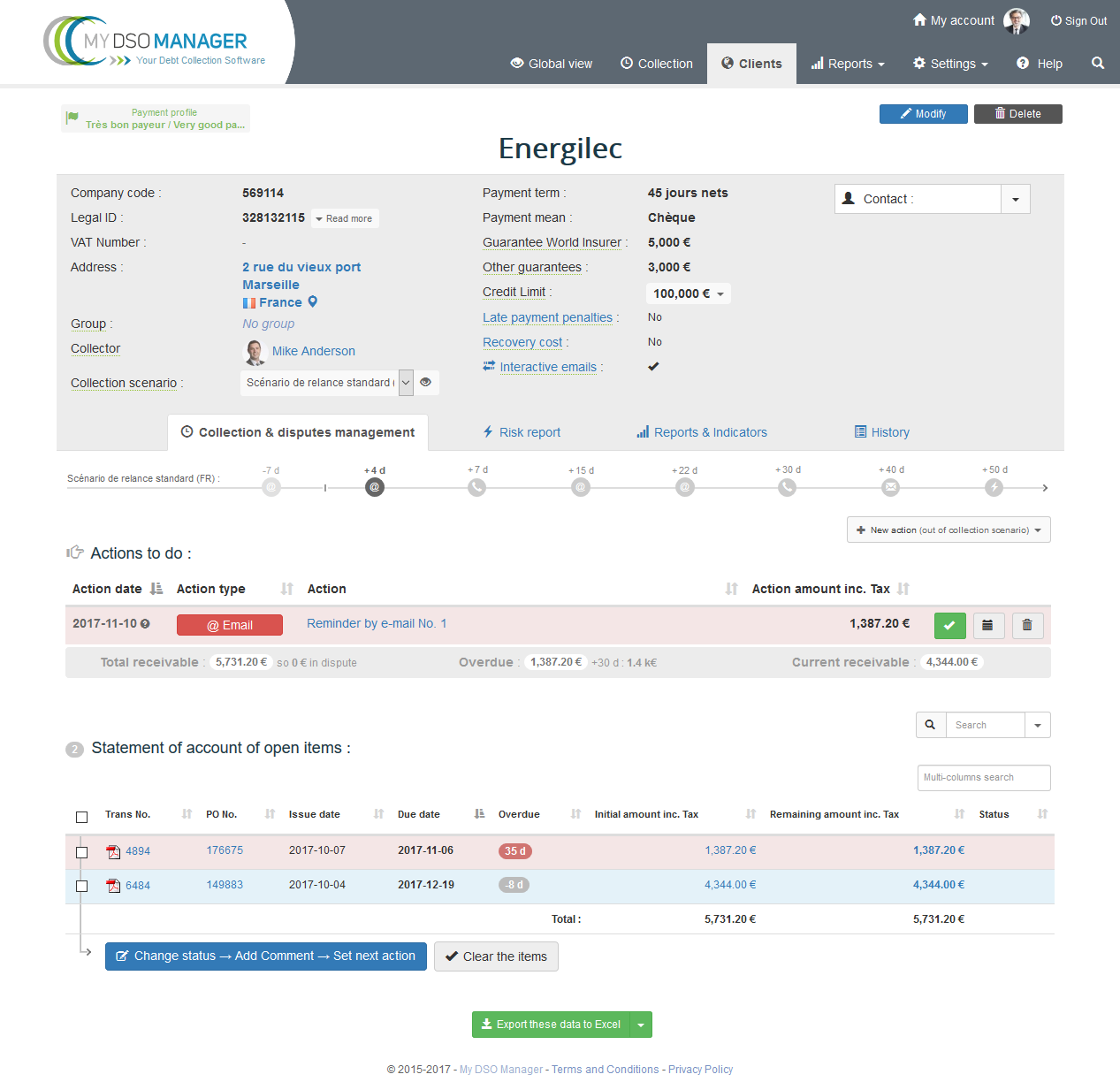

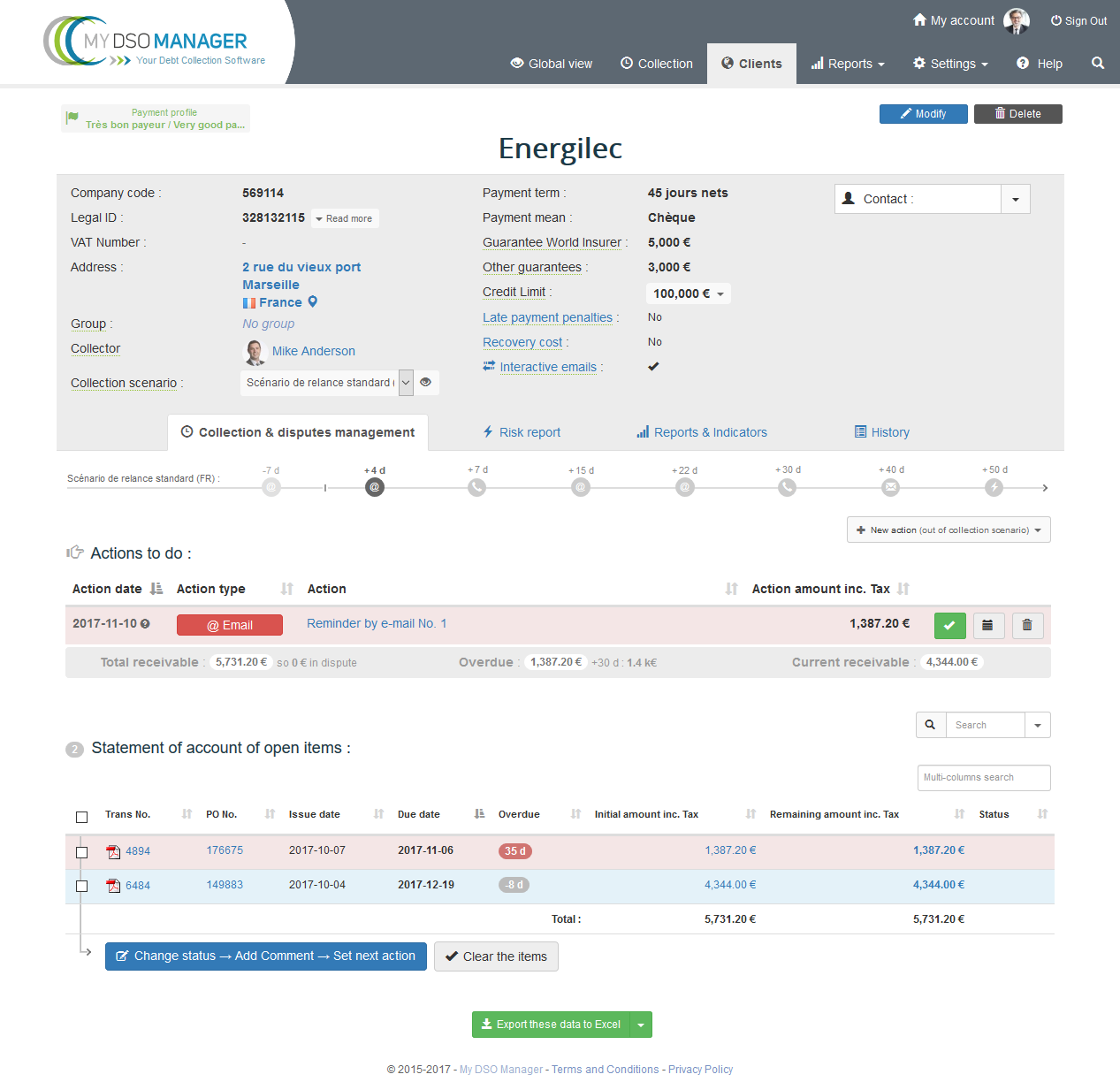

Cash collection

- Create and assign to each of your customers a recovery scenario based on its typology (risky client, public ...).

- Create your collection templates dynamically (e-mails and letters) while maintaining the ability to customize them in the completion of the action.

- Automatically insert in your models through #Hashtags late payment penalties, statements of account, bank details of your business and many other information.

- Give to your customers access to their account situation thanks to interactive e-mails allowing them to reply to you directly in the application.

- Add a comment and status to invoices after each customer feedback, to keep the history and to prepare the next action.

- Set up automatic reminders that will be sent if the bills are not paid on time.

- Identify disputes and drive their resolution urging the actors in your business who can solve them.

- Manage the recovery by payment center and the customer risk by legal entity in case of multiple accounts for the same buyer.

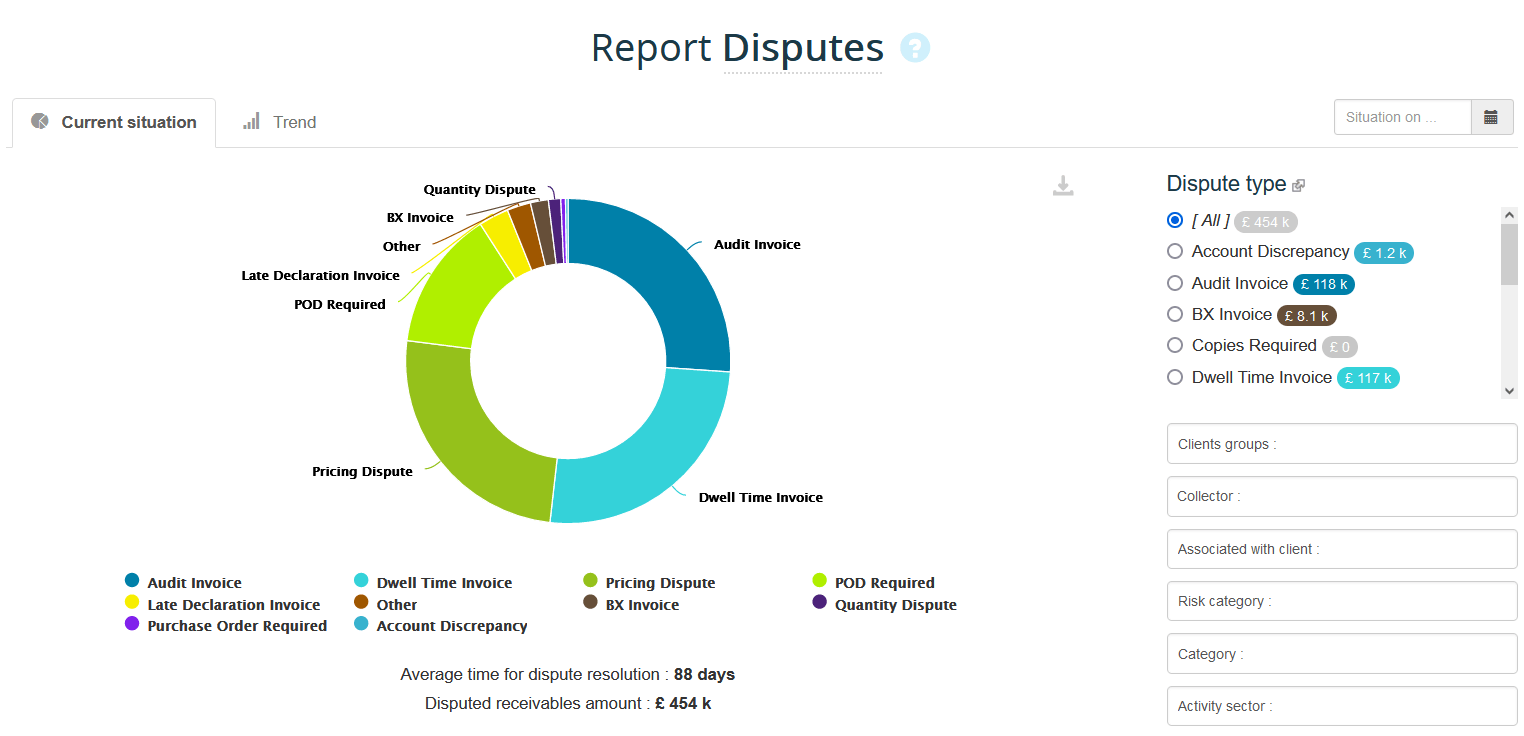

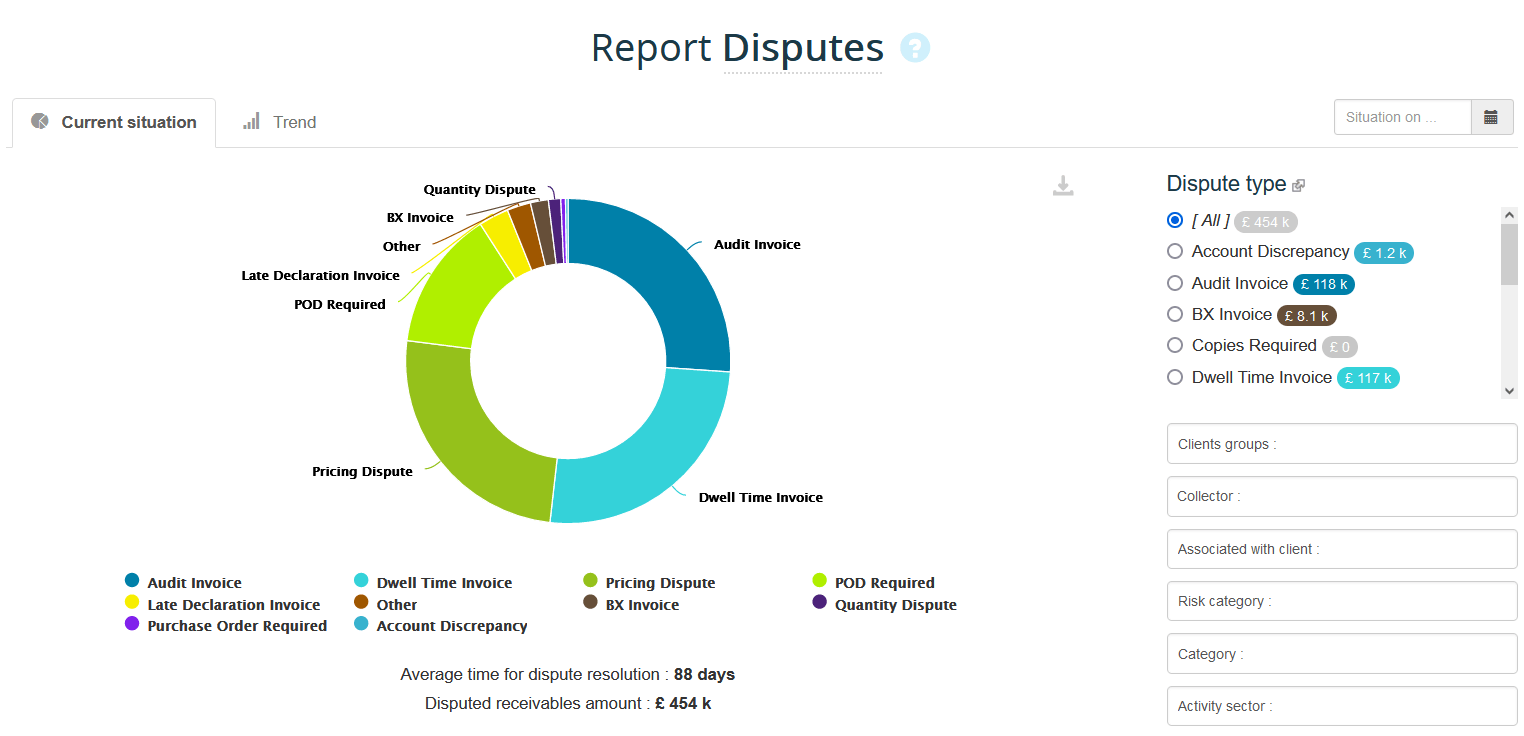

Dispute management

- Identify disputes during your dunning.

- Take into account the customer expression via comments.

- Qualify your transactions with an appropriate status (Price dispute, administrative dispute, ...).

- Involve the internal actors of your company (sales managers, customer care center, ...) during the collection process.

- Track the disputes resolution by performing internal follow-up actions.

- Improve your performance by knowing the resolution time calculated in days.

- Turn the resolution of your disputes into an opportunity to improve Customer Satisfaction.

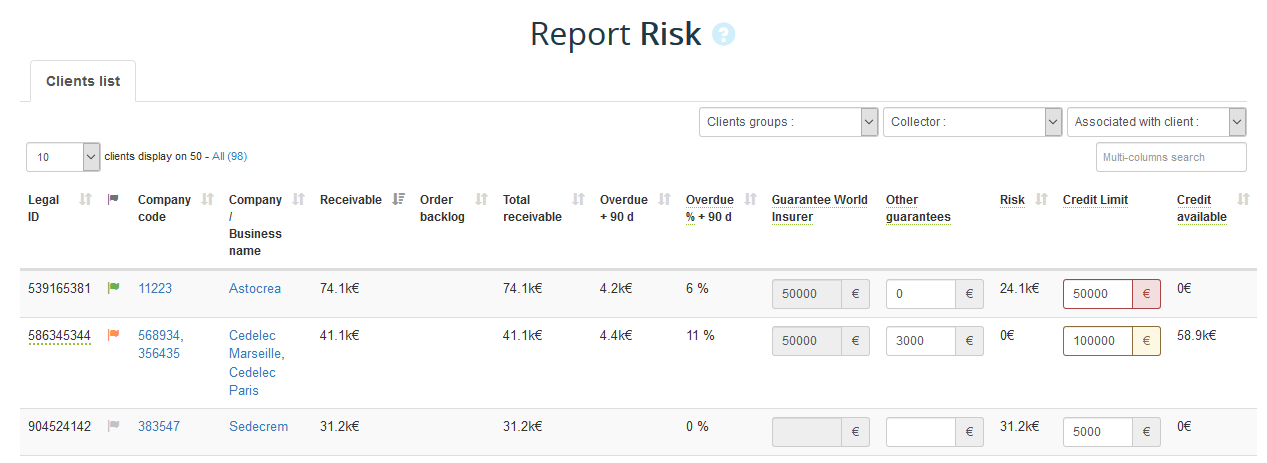

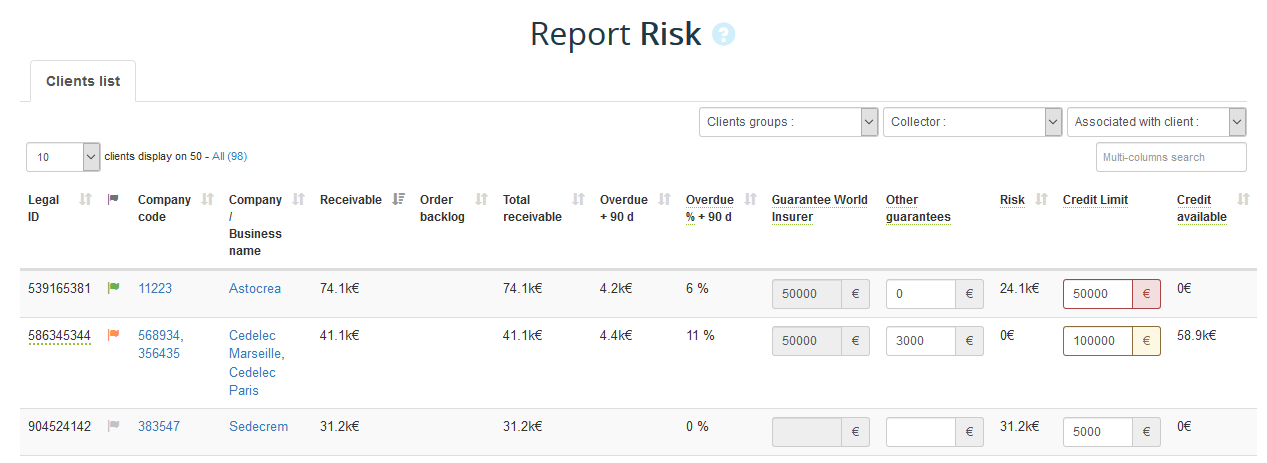

Risk management

- Make a scoring your customers and set a credit limit for each of them with dedicated tools.

- Integrate your credit limit validation process and have them validated in My DSO Manager.

- Manage your risk with the Risk report and carry out credit analysis.

- Create alerts to highlight customers in anomaly (exceeding credit limit or insurer guarantee ...)

- Manage your credit insurance by controlling the reporting deadlines.

- For Groups, consolidate your data between several entities allowing you to obtain a consolidated view of the outstanding amounts of your key account customers.

- Manage multiple currencies whose rates are updated daily and automatically by the software.

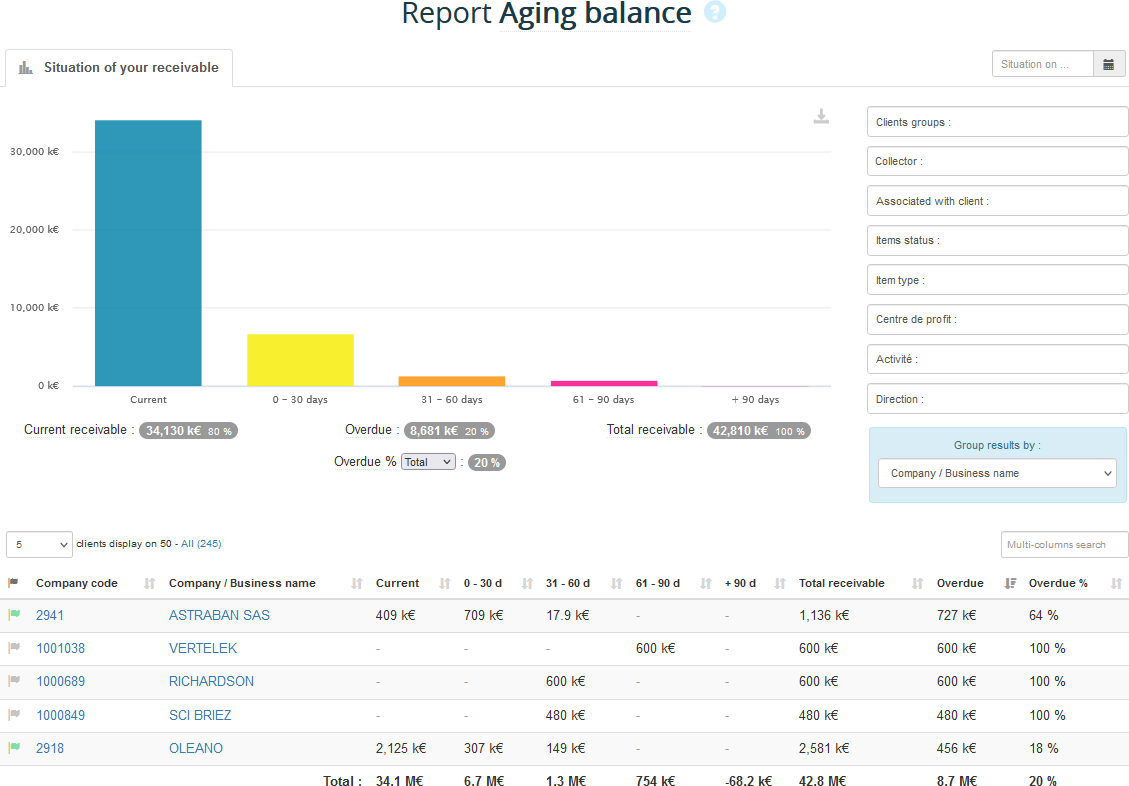

Performance Management

- Get reports about the DSO, ageing balances , credit risk, dispute and sales for all of your customers, by customer group and per client.

- Measure the actual payment behavior of your customers and their average delay in payment.

- Give access to the software to the actors of your company including sales managers to get them involved in debt recovery.

- Manage your Group's performance indicators thanks to our multi-entity platform which manage an unlimited number currencies and offer consolidated reports in real time.

You can now: