Assessing the creditworthiness of customers and then adapting payment conditions accordingly are the first key steps to avoid bad debts and late payments.

My DSO Manager, full Credit Management solution, allows to analyze and control the risk with several integrated functionalities:

News for multi-entity users! New functionalities make possible to get a consolidated view of outstandings and risk of a common client to several entities (or countries) as well as a global risk report for the entire group.

My DSO Manager, full Credit Management solution, allows to analyze and control the risk with several integrated functionalities:

- Dynamic tracking of outstandings, guarantees management (credit insurers, banks, ...) and credit limits per customer.

- Global view with the risk report • Consolidation of customer risk by legal entity (if multiple accounts for the same customer).

- Customizable multi-criteria scoring templates, tool for calculating credit limits, daily credit analysis comments.

- Credit limit validation workflow • Customers' payment profiles • Alerts • ...

- Connectors with credit insurers and financial information providers:

Creditsafe,

Creditsafe,  Ellisphere,

Ellisphere,  Infolegale,

Infolegale,  Altares (Intuiz+),

Altares (Intuiz+),  DNBi (Dun & Bradstreet), ...

DNBi (Dun & Bradstreet), ...

News for multi-entity users! New functionalities make possible to get a consolidated view of outstandings and risk of a common client to several entities (or countries) as well as a global risk report for the entire group.

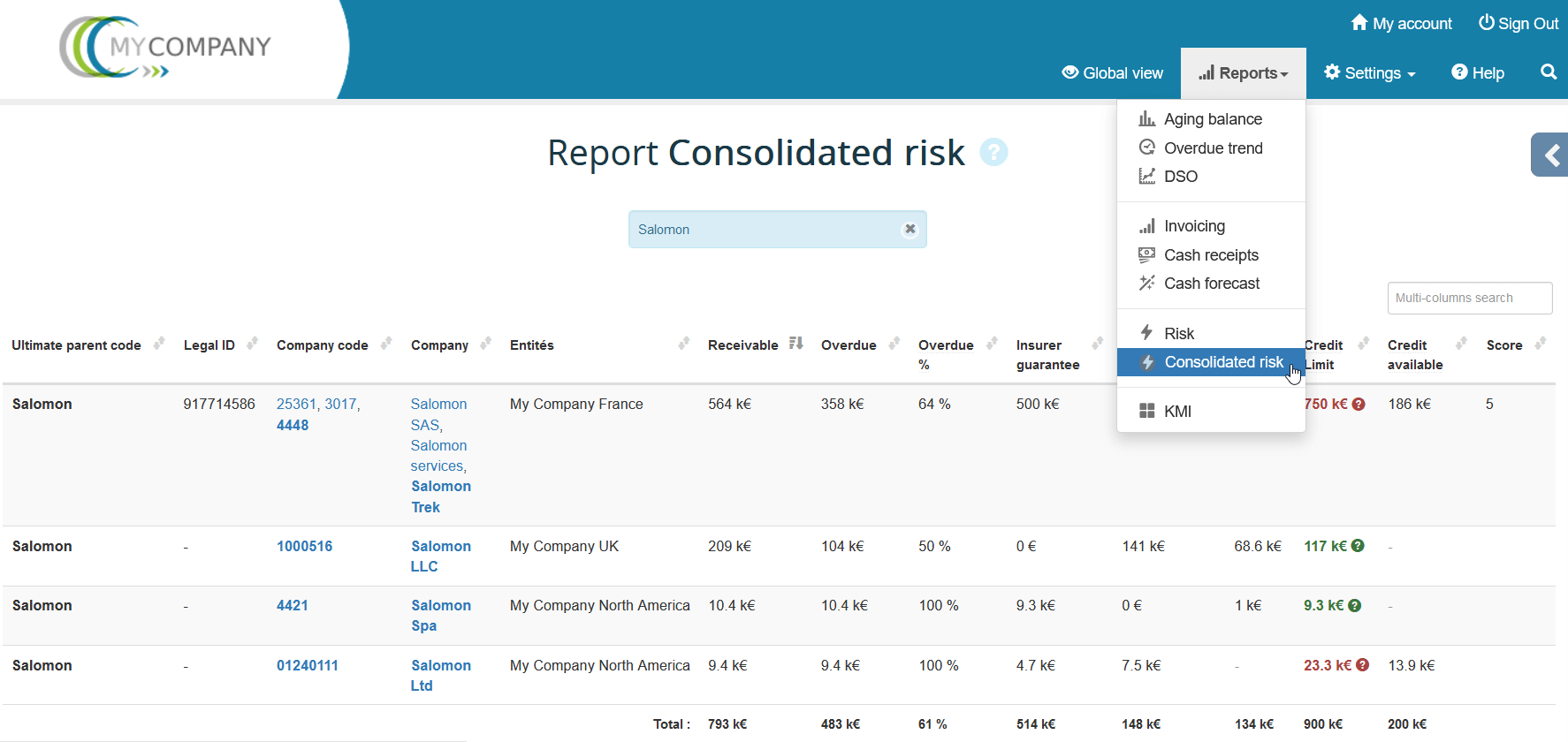

- Ultimate Parent Number: Do you have a common client to multiple entities in different countries? Add to each of the account concerned the same "Ultimate Parent Number" that allows to consolidate its data. Example with the company "Salomon", customer of several entities of the group Multi in several countries:

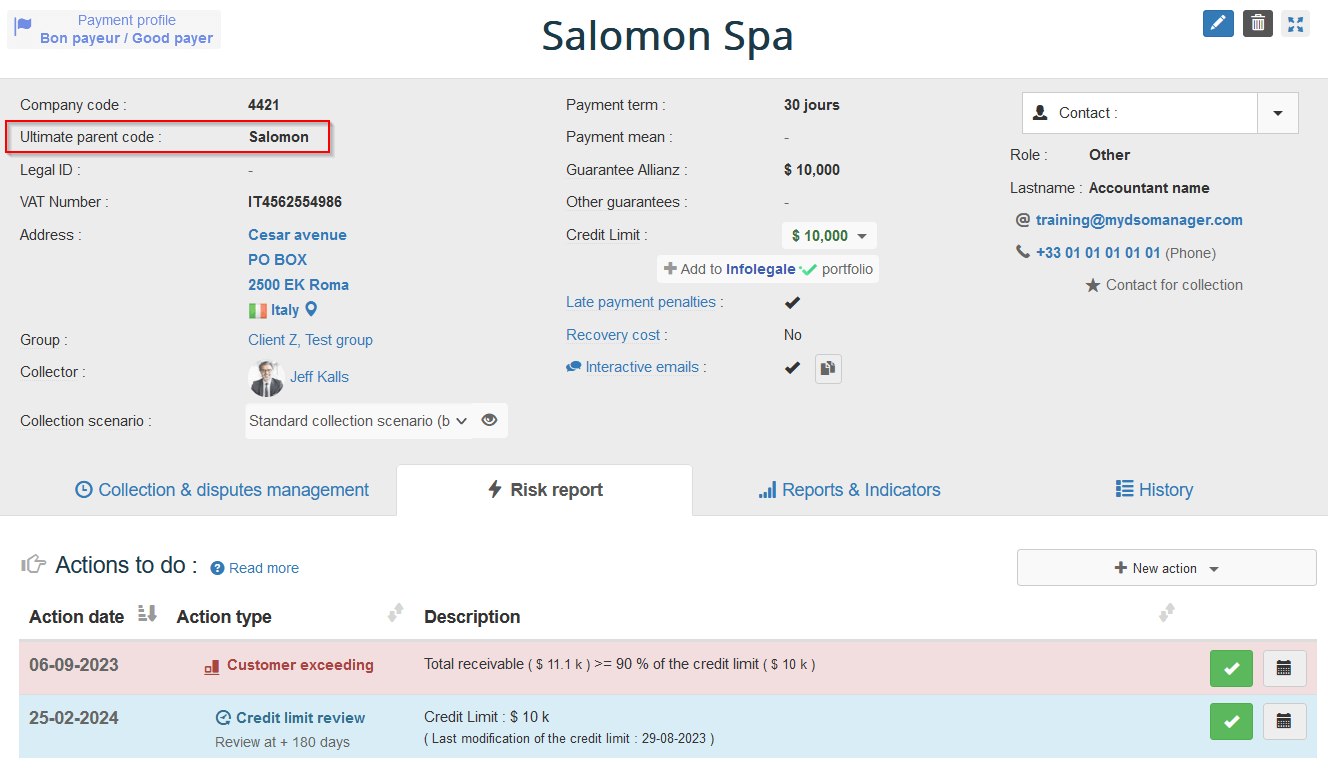

- Add the Ultimate Parent Number in customer sheet:

- Consolidated multi-entities risk report of "Salomon":

- Add the Ultimate Parent Number in customer sheet:

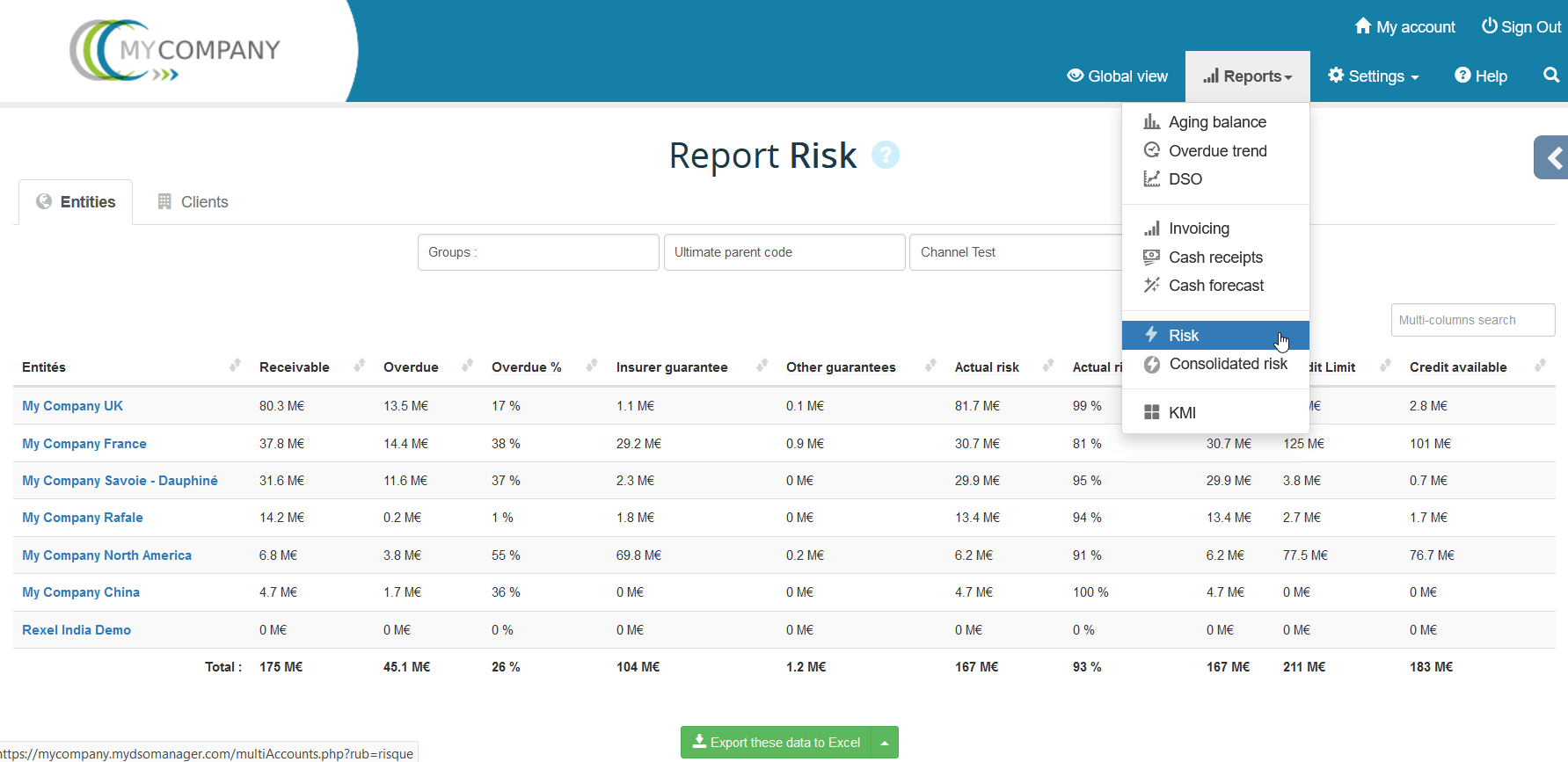

- Multi-entity risk report ? What is the risk exposure of your group? Get a consolidated view with this multi-entity report:

List of last topics in the online help: