Credit insurance is a particularly useful tool in managing a company's receivables. It fulfills several financial and qualitative objectives:

Credit insurance is a particularly useful tool in managing a company's receivables. It fulfills several financial and qualitative objectives:- Prevention of credit risk through precise monitoring of buyers' solvency, as well as other types of risks such as political or sectoral risks.

- Compensation in the event of non-payment, which at least partially preserves, depending on the guaranteed portion, the company's results.

- Structuring the sales process, in particular the creation of customer accounts and the outstanding amount granted, the recovery of receivables, up to the final receipt of payment.

One of its key success factors is its "plug & play" interconnection with a multitude of third-party systems such as credit insurers. By activating your insurer's connector, find your guarantees, scores, and changes on a daily basis in My DSO Manager. This information, always up to date, is used to put your guarantees into perspective with your actual outstanding amounts, to manage your deadlines, your credit limits, foreclosure deadlines, etc. My DSO Manager thus allows seamless management of your credit insurance policy in line with your contractual clauses to exploit all of its benefits without risking finding yourself in a situation of default:

Main features regarding credit insurance

The software allows for complete management of your credit insurance contract by consolidating all data (outstanding amounts, guarantees, credit analyses, financial information, etc.), and thanks to advanced functionalities such as:- Plug & play connectors with the main credit insurers allowing you to retrieve daily the guarantees granted, your customers' scores as well as multiple other historical information on My DSO Manager:

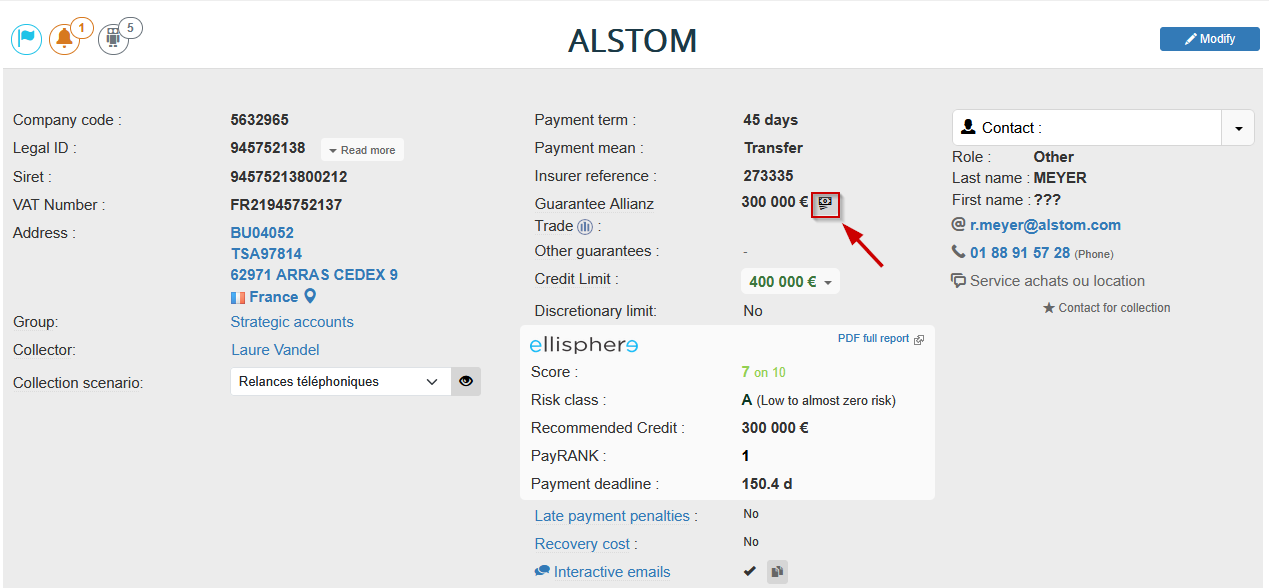

- Requests for guarantees and requests for insistence from your credit insurance broker directly in the software and without going through the credit insurer's platform. Button to trigger a guarantee request from the customer file:

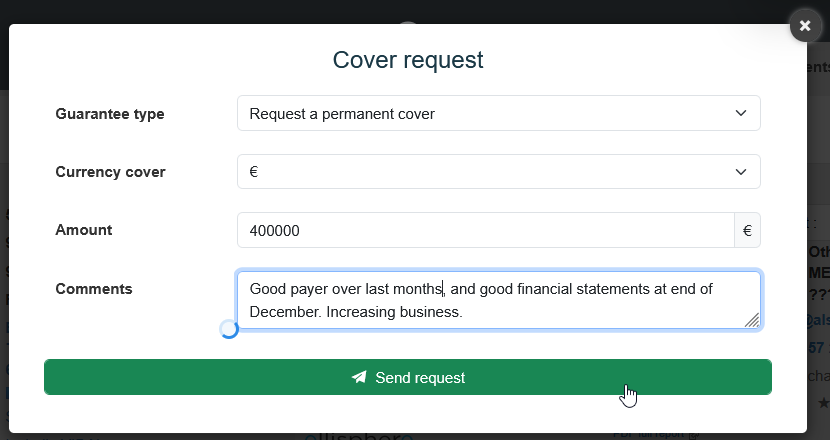

Then choose the type of guarantee desired (permanent, temporary, top-up, CAP, etc.) and the amount:

- Automatic management of unnamed customer guarantees or discretionary limits using AI Search & Assign.

- Alerts in the event of foreclosure or default, for example, monitoring of uncovered outstanding amounts, taking into account guarantees in the debt recovery process, claims declarations, etc., allow for optimum management of the credit insurance policy.

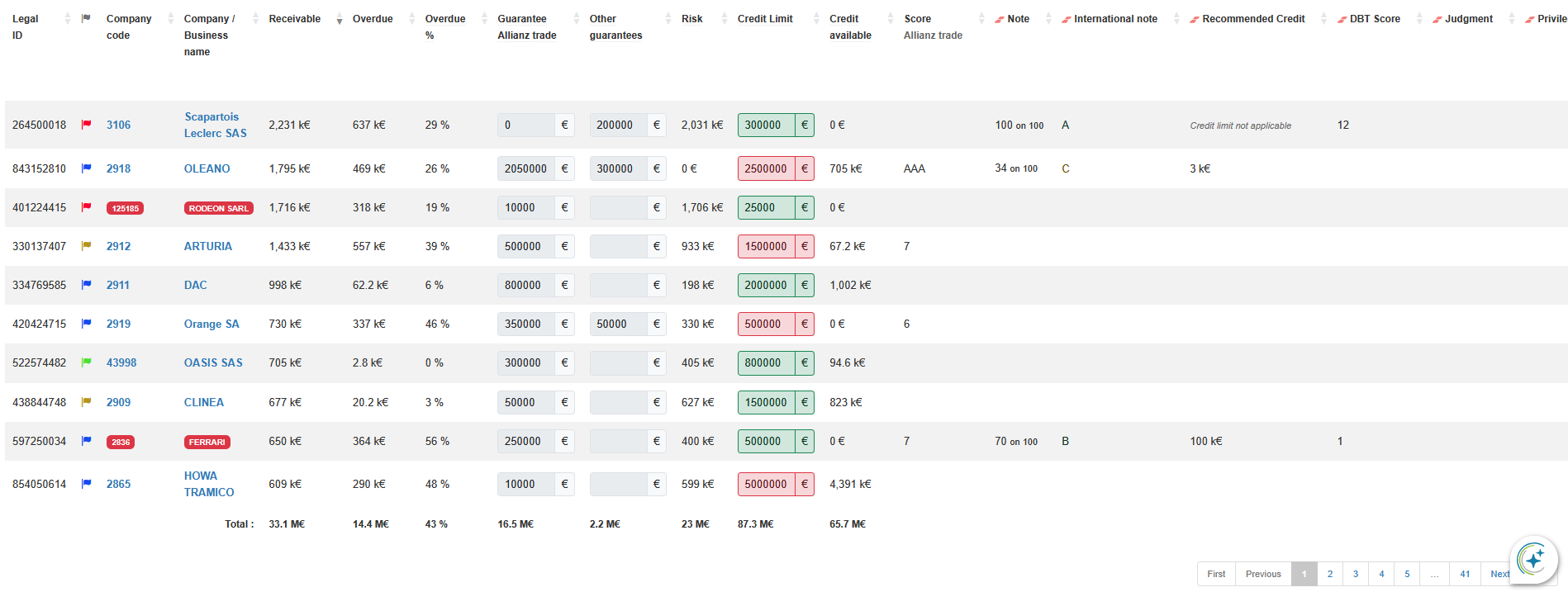

- Risk reports for each entity or at the group level to consolidate multi-entity customer data.

- Interactions with financial information providers that provide a comprehensive view of a buyer's financial situation, the history of their relationship (payer profile) and thus provide arguments to obtain more guarantees.

- Workflow for validating credit limits, based on actual outstanding receivables and the guarantee amount.

- Risk agenda permettant de piloter les différentes échéances et actions de suivi.

- Specific reports for making turnover declarations to the credit insurer.

- Etc.

You can also find our tutorials on credit insurance on Credit Management tools, including:

- What is credit insurance ?