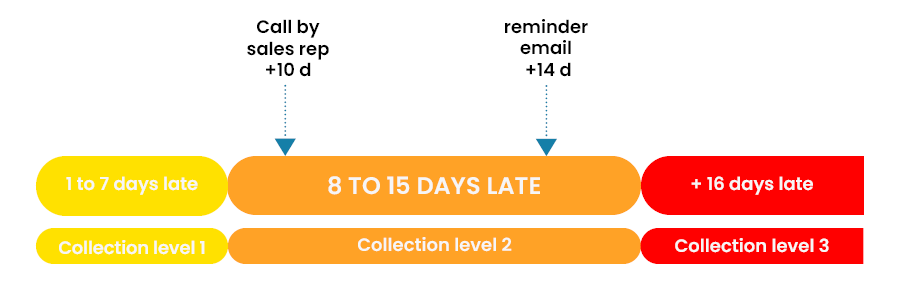

Collection Level 2 is the third stage of a standard collection scenario. You must tailor it to your company's activity sector, customer types, and commercial strategy. It happens when payment is still not receibed after multiple attemps to collect. This occurs even after trying to resolve any issues during the pre-dunning and collection level 1 phases.

At this stage (between 8 and 30 days late), the situation becomes alarming. No minor reason (check lost, accountant out of office, etc.) can justify this delay.

It is therefore necessary to identify the cause of non-payment. Are we currently addressing a dispute or an administrative issue?

In this case, the role of the cash collector is to manage the resolution of the identified problem. They will involve both internal (sales, technicians, logistics, etc.) and external (accounts payable, purchaser, etc.) stakeholders in the process. The objective is to resolve the problem as quickly as possible to obtain a settlement.

![]() The collector's role is to send out invoices to customers, in most cases, customers need to pay the confirmed invoice. Internal stakeholders who can resolve the issue will take care of the other invoices. After resolving the dispute, the collector informs the customer of the positive outcome. He then requests payment for the remaining balance.

The collector's role is to send out invoices to customers, in most cases, customers need to pay the confirmed invoice. Internal stakeholders who can resolve the issue will take care of the other invoices. After resolving the dispute, the collector informs the customer of the positive outcome. He then requests payment for the remaining balance.

![]() Good management involves precise monitoring and effective communication with different people, providing them with timely and relevant information. "Communicate to get action" is one of the cash collection officer’s credos. For this, using a collaborative and digital collection software is essential for performance.

Good management involves precise monitoring and effective communication with different people, providing them with timely and relevant information. "Communicate to get action" is one of the cash collection officer’s credos. For this, using a collaborative and digital collection software is essential for performance.

To claim a debt, your invoices must be liquid, certain and due. If they have those three requirement and you are still waiting, your buyer may not pay for two reasons. The first reason is they simply don't want to pay. The second reason is they can't pay because of important financial or administrative problems.

If the delay is entirely the customer's responsibility, it is necessary to chase him up more firmly than before. This happens when there is an absence of dispute justifying the nonpayment. You can do so by varying the modes of recovery (e-mail, interactive e-mail, phone, postmail).

You shall involve your business colleagues who can intervene with the client such as sales manager or director. Then send a new dunning letter with an acknowledgement of receipt requiring immediate payment. We recommand registered electronic delivery, let's forget paper.

You shall follow this dunning letter quickly by an e-mail or a phone call firmer than the previous one. Your customer must understand that your recovery actions are professional and will continue regularly until he pays your bills.

![]() Require your customer to pay late payment penalties to offset the cost of overdues. Payment penalties in case of late payment are mandatory in several countries (EU, for example). In addition, requesting late payment penalties will help educate your customer to pay you on time.

Require your customer to pay late payment penalties to offset the cost of overdues. Payment penalties in case of late payment are mandatory in several countries (EU, for example). In addition, requesting late payment penalties will help educate your customer to pay you on time.

Collection level 2

This stage intervenes after the pre-dunning action, then the collection level. The reminders are firmer than the previous ones and requires the intervention of other actors in the company. The buyer must understand that this situation of late payments is abnormal. The seller clearly wishes an immediate regularization.

Examples of actions carried out during this phase:

-

My DSO Manager, the online cash collection software

My DSO Manager offers powerful features to make quality reminders at the right time.

The trigering of dunning actions depends on many criteria. Those are the collection scenario assigned to,the situation of the account, the status and history, etc.

#Hashtag allows to dynamically generate dunning e-mail which are customizable for optimum efficiency. See the demo.

Keep a record of all your reminders, from the first recovery to the last one. Prepare each call based on previous exchanges. This allows you to structure your call and ensure the buyer does not have the same reason to not pay every time.

You must do your customer reminders in a funnel to get your customer to pay you. They should have no other alternative but to confess that they cannot pay you if this is the case. If yes, it is possible to discuss the terms of a possible payment schedule, taking into account reciprocal constraints. This kind of support during difficulties depends on the relationship, trust, and flexibility of your company.

![]() The intervention of the sales representative is often truly effective at this stage of the process. Indeed, he does not have the same contacts as the person responsible for bill collection. This person is in connection with accounting services while sales representative will use their personal relationship within the company. They will contact the purchasing manager or director of the company to quickly release the payments for bills due.

The intervention of the sales representative is often truly effective at this stage of the process. Indeed, he does not have the same contacts as the person responsible for bill collection. This person is in connection with accounting services while sales representative will use their personal relationship within the company. They will contact the purchasing manager or director of the company to quickly release the payments for bills due.

![]() Use the blocking of the account as a recovery tool: "We will be able to deliver your last order upon receipt of your payment." This will be enough to convince many clients to pay you. If your client is unable to pay your invoices, blocking deliveries will limit the potential unpaid amount.

Use the blocking of the account as a recovery tool: "We will be able to deliver your last order upon receipt of your payment." This will be enough to convince many clients to pay you. If your client is unable to pay your invoices, blocking deliveries will limit the potential unpaid amount.

This phase is therefore intermediate and aims to clarify the situation by identifying and resolving problems. The collector's skill lies in precisely defining the nature of the unpaid debt and tailoring his actions accordingly. They ensure that no excuse remains for not paying the invoice. During this period, we must regularize the vast majority of late payments.