How to transform DSO through digitalization?

DSO (Days Sales Outstanding) is often considered an essential performance indicator in credit management. It is defined as the number of days during which recognized turnover remains uncollected. At first glance, it seems to be a simple tool, but its interpretation and calculation reveal a certain complexity, which makes it a controversial indicator and a source of heated discussions among credit managers.One question appears essential: is it really a relevant indicator? To answer this question, it is essential to understand the multiple facets of DSO, its strengths and weaknesses, and especially the impact of digital tools on this historical indicator of the credit manager.

Second equally important question: how do digitalization and specialized software radically change this indicator, to the point of modifying its nature and meaning?

The DSO and its components

Contrary to popular belief, DSO does not represent the average payment period of customers. How could it? It concerns receivables not yet paid, whether due or not, and is not based on payment history. It is influenced by several factors such as the payment terms granted to customers, deposits received, late payments, certain contractual conditions, etc. Consequently, this indicator reflects the overall performance in Accounts Receivable management integrating risk management, contractual conditions and deadlines, cash collection, dispute management, etc.In essence, the DSO is based on three main components:

- The contractual payment term granted to customers, often resulting from the company's commercial policy and commercial negotiations,

- The advance payments received, which are deducted from the overall outstanding amount of receivables,

- Late payments by customers, whether justified or not, which feed into the "late" DSO.

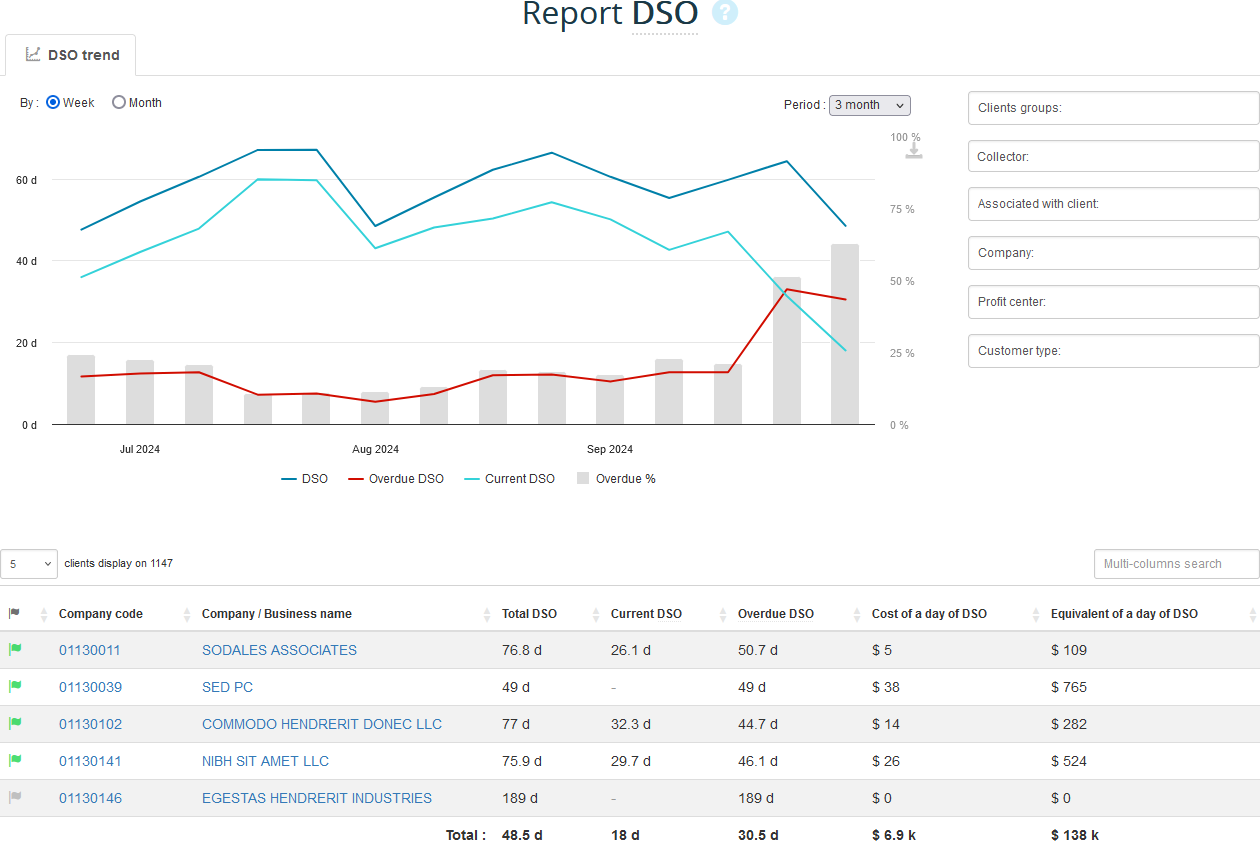

Thanks to digital tools and the exponential increase in calculation capacities, DSO can now be calculated in real time on an unlimited number of perimeters: by segmentation or activity at the customer or accounting document level, by user portfolio, at the global level for a group or by entity. Rather than a single monthly figure, it can therefore be declined infinitely by month, week, or even by day. The indicator therefore no longer has much in common with the DSO known until now, reported once a month in accounting reporting tools. It is much more dynamic and the analysis of its components and its evolution is done in a few clicks.

The challenges of calculating DSO

One of the main difficulties in using the DSO lies in its calculation method. We have seen that there are several approaches to calculating this indicator, the two most common being the balance sheet method and the roll back method (exhausting outstanding amounts by turnover). Each method has advantages and disadvantages, even if the roll back method seems the most relevant.- The balance sheet method uses data from the balance sheet and the income statement. It is simple to apply with a calculation such as: customer outstanding including tax x number of days in the period / turnover including tax for the period, but it can be very volatile, particularly depending on changes in turnover.

- The roll back method is more stable. It consists of subtracting the turnover of the period from the unpaid receivables by incrementing the DSO by the number of days in the period, until exhaustion. The last period is prorated, which is a factor of imprecision. This method is therefore all the more precise as the chosen period is short. For example, the DSO calculated over successive periods of seven days will be more accurate than if it is one month.

Find here our online DSO calculation tool.

Some factors impacting DSO

DSO is the result of everything that happens during the company's sales process, from commercial negotiation to payment collection. It is therefore closely linked to the quality of credit risk management, which aims to prevent the risk of late payments and non-payments by setting up the conditions (payment, contractual, coverage) allowing the sale to be carried out with an acceptable risk. The term "acceptable" depends on the assessment of each company, its activity and its strategy. Proactive management of customer risk involves regularly assessing customer solvency and behavior, obtaining deposits when ordering, and using receivables security tools such as credit insurance, bank guarantees or documentary credit.Another essential contributory element to DSO, which alone indicates the quality of a company's internal organization: the frequency and processing of disputes. Disputes, which are a priori valid reasons for non-payment of invoices, highlight all the dysfunctions in the sales process. Dispute management, which includes the identification and (rapid) processing of disputes, quantification by type of dispute and processing of causes, is an essential vector for improving DSO in many companies. Here, the positive effects concern cash flow, profitability and customer satisfaction.

Optimizing DSO: a question of tools and processes

Improving DSO is often considered a "Holy Grail" in Accounts Receivable management, because it frees up cash and reduces Working Capital Requirement, of which it is one of the main components. DSO is also often considered a key indicator by corporates, especially those of Anglo-Saxon culture, who tend to give it sometimes disproportionate importance by promoting it as the main performance indicator, which is a mistake, especially if its components are not analyzed and evaluated.Companies can traditionally improve their DSO by acting on several levers:

- Shorten payment terms negotiated with customers.

- Obtain deposits when ordering to reduce outstanding balances.

- Offer discounts to encourage customers to pay more quickly and before the due date.

- Optimyze cash collection thanks to more rigorous and qualitative management of reminders and dispute management.

- Entice customers to pay via modern, instant payment methods.

Like B2B customer relations and credit management, DSO is undergoing profound change due to the radical transformation of its calculation and interpretation provided by high-performance credit management softwares. Between an indicator calculated globally once a month and another calculated in real time over an unlimited number of areas, the difference is immense. It reflects the possibilities for action and progress that the credit manager obtains, through his digital tool, to contribute to the success of his company.