My DSO Manager offers many key reports on all aspects of credit management. They can be divided into several parts:

My DSO Manager offers many key reports on all aspects of credit management. They can be divided into several parts:- Collection efficiency reports

- Credit risk management

- Forecasting

- Corporate reports consolidated in real time or report at entity level

- Custom reports

Some example of reports available :

Aging Balance

Must have report for the management of debt collection, the Aging balance in My DSO Manager is displayed with dynamic graph and a table with customer where it is possible to sort by many criteria, including the brackets of delay (overdue 1 - 30 days...).Disputes

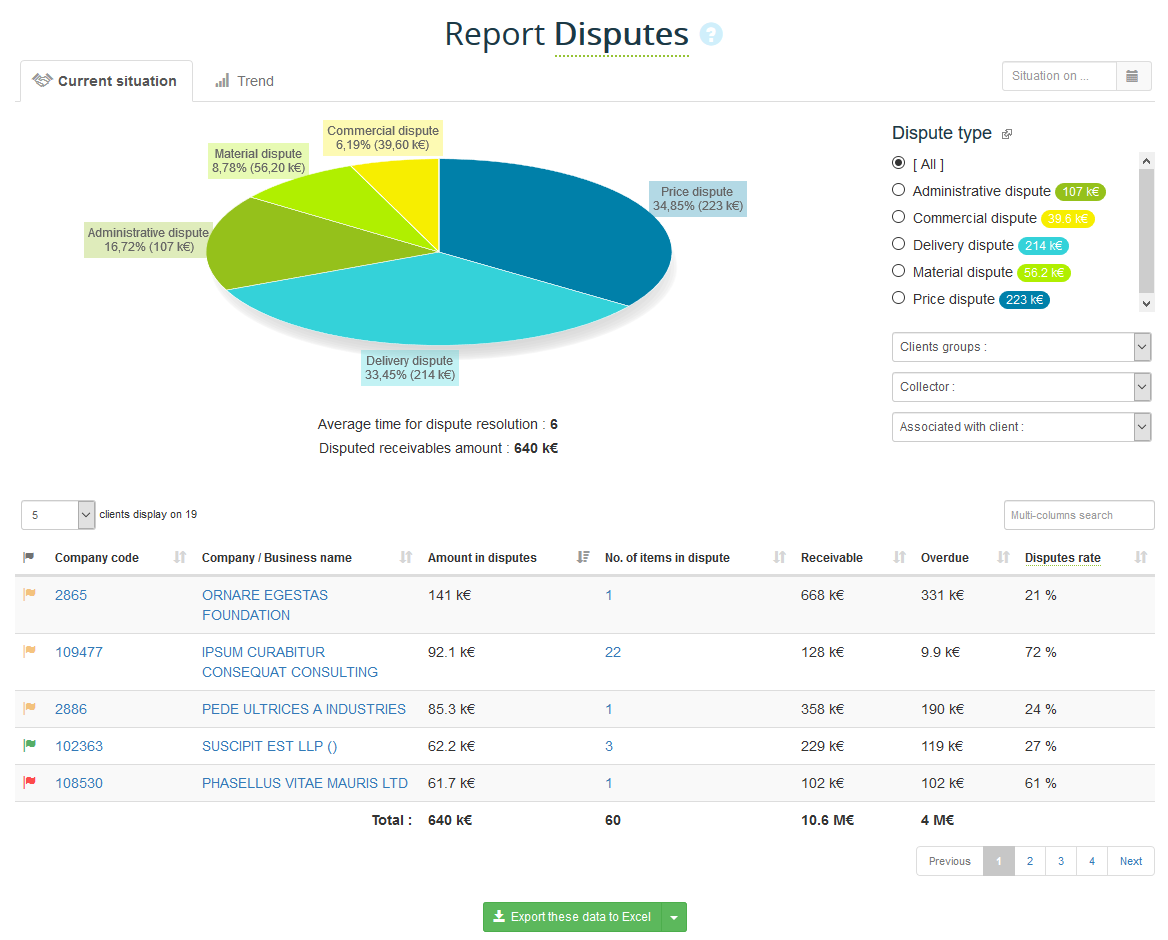

The Disputes report identifies the main causes and the amount of receivables pending payment for disputes reasons. It also gives the breakdown by customer (in number and amount), as well as by type of dispute, in order to understand which customers or sectors of the company are affected by these malfunctions.

DSO

Get the DSO of your company splitted in current DSO and overdue DSO.Key performance indicator of the receivables management, DSO monitoring is a major asset for cash flow optimization.

Items Status

In My DSO Manager it is recommended to qualify unpaid invoices using the corresponding statuses (unlimited number and fully customizable), which ensures that all outstanding receivables are followed.

Risk

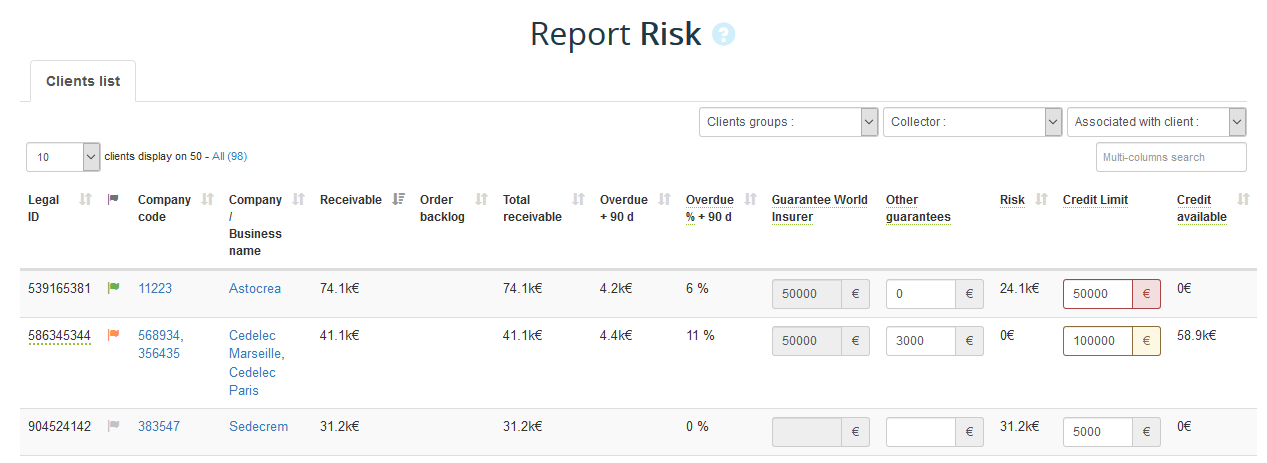

This report makes it possible to control the outstanding customers amount in relation to their credit limit and the payment guarantees obtained (credit insurance guarantees, bank guarantees,...).

It also highlights available outstandings and customers who are over the credit limit for good reasons (growth in sales) or bad (unpaid invoices).

Cash forecast

In My DSO Manager the cash forecast calculation is based on:

- the collection work done (items qualifications)

- your customers payment behavior constated in My DSO Manager

- your company performance in dispute management

- the exclusion of the items qualified in "litigations"

Overdue trend

It measures the debt recovery performance, highlighting the causes of deterioration and improvement.

And many others...

My DSO Manager also propose:

- A Cash receipts report which allows you to visualize the receipts of your customers on different perimeters

- In order to follow the global activity, in groups or by customers of your company My DSO Manager integrates a Sales report

- You also have the opportunity with Payment schedule report the to view the distribution of your receivables plus outstanding items in different brackets according to their due date...